What I'm learning from investing in B2U Storage Solutions

2 charts on duck anatomy and the coming wave of 2nd-life EV batteries

Welcome to My Next Electric’s weekly newsletter on the clean energy transition, especially the electrification of traditionally fossil-fueled stuff. If you were forwarded this post and liked it, please subscribe to My Next Electric!

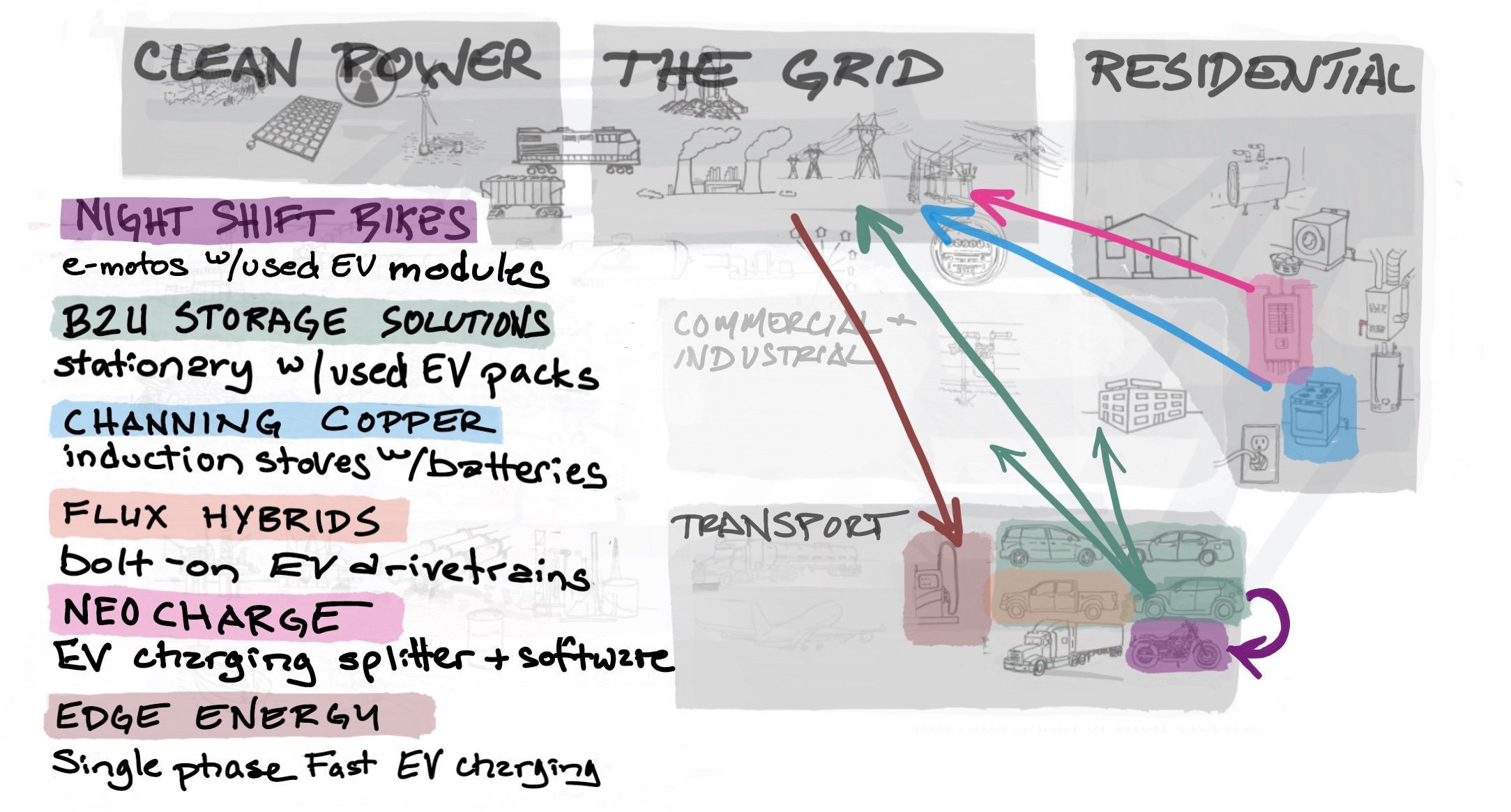

Each week we cover one of these:

Investments: a company we’ve invested in and/or why we invest the way we do,

Motonerd stuff: cool stuff that might expand what vehicles can do for us, or

Learning science: ways we can break through our resistance to going electric even when it’s better for us and our wallets.

This week is post 3 in a series on our emerging investment thesis, Batteries Included:

Post 1, on creating our investing map is here.

Post 2, on how building electric motorcycles informs it is here.

This post and the next are on my 2020 investment in B2U Storage Solutions.

B2U: Large-scale energy storage using 2nd-life EV batteries

This innovative company takes used EV battery packs out of vehicles and re-deploys them as stationary storage on the power grid.

This post is on the problem B2U addresses — the daily intermittency that comes with adding solar generation to the power grid.

The next will be on where B2U is today.

My B2U journey started in 2019 during a series of phone calls with one of my oldest friends, Freeman Hall, who was running a profitable solar development company in California.

He was thinking about the future of grid-scale solar. He was a pro.

I was thinking about the future of electric motorcycles. I was an amateur.

A super curious amateur. 25 years into a career in education, I’d never felt more engaged in my own learning than when I was surfing message boards and stalking builders at motorcycle shows in my quest to convert vintage gas motorcycles to electric.

I was wondering — out-loud to anyone who’d listen — if jamming batteries into old bikes might lead to more than a hobby. Freeman was one of a few willing to go down that rabbit hole with me.

Turns out he’d been thinking about batteries longer than I had.

Freeman explains our intermittent future to me

As we talked about where the grid-scale solar world was headed, Freeman kept referring to duck anatomy. Always a a sucker for a good metaphor, I took the bait…

Go onnnnn.

He walked me through what was happening on the California grid and the wacky poultry visual that summed it up.

More wind and solar was awesome - cheaper, cleaner, abundant.

But adding lots of wind and solar meant ramping up with other sources when the sun set or the wind tailed off.

And since existing power plants weren’t built to ramp up and down fast enough to serve as good complements to solar, we’d need something different, and soon.

Then he showed me this 2013 chart by CAISO, the California Independent System Operator.

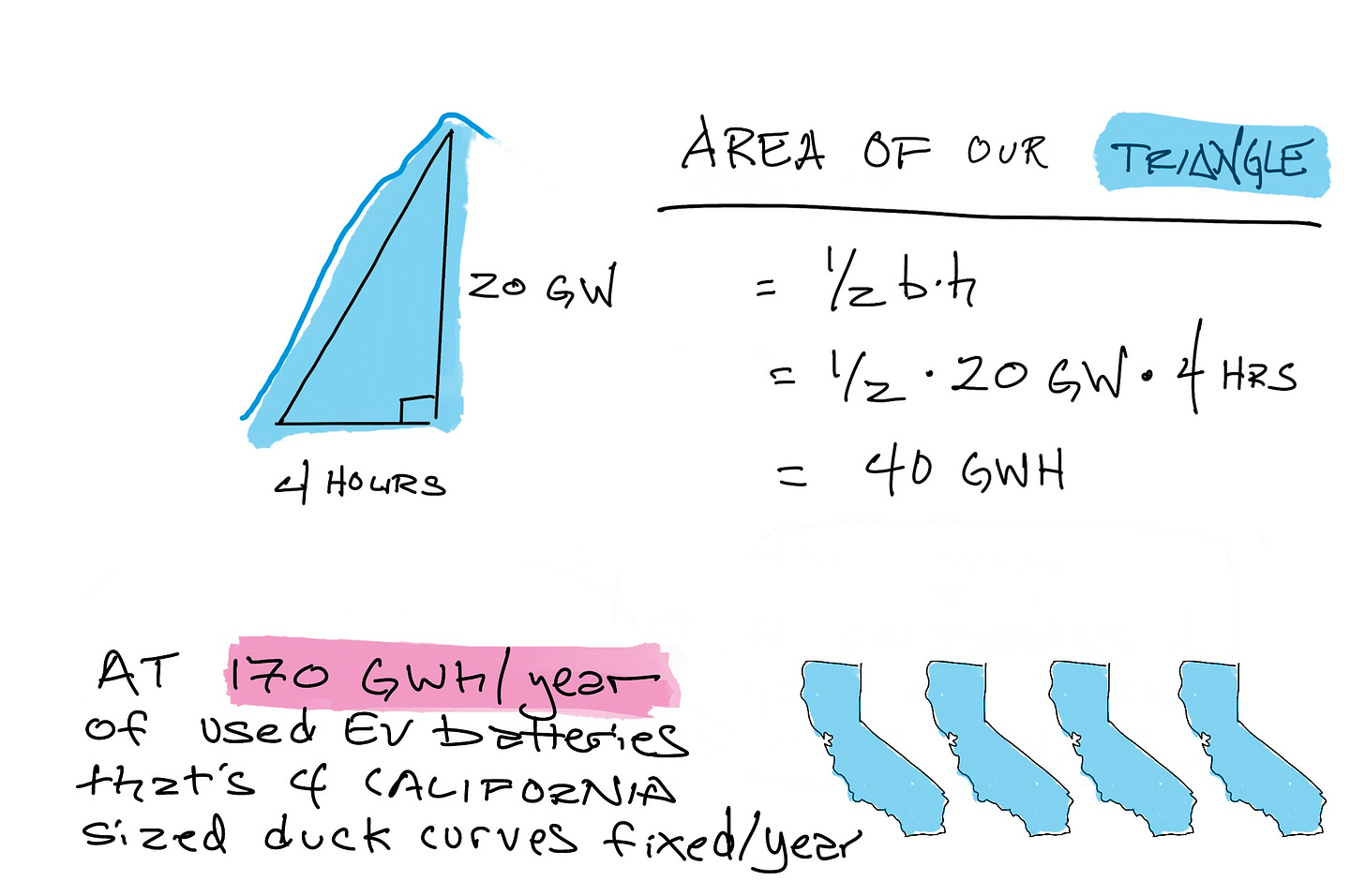

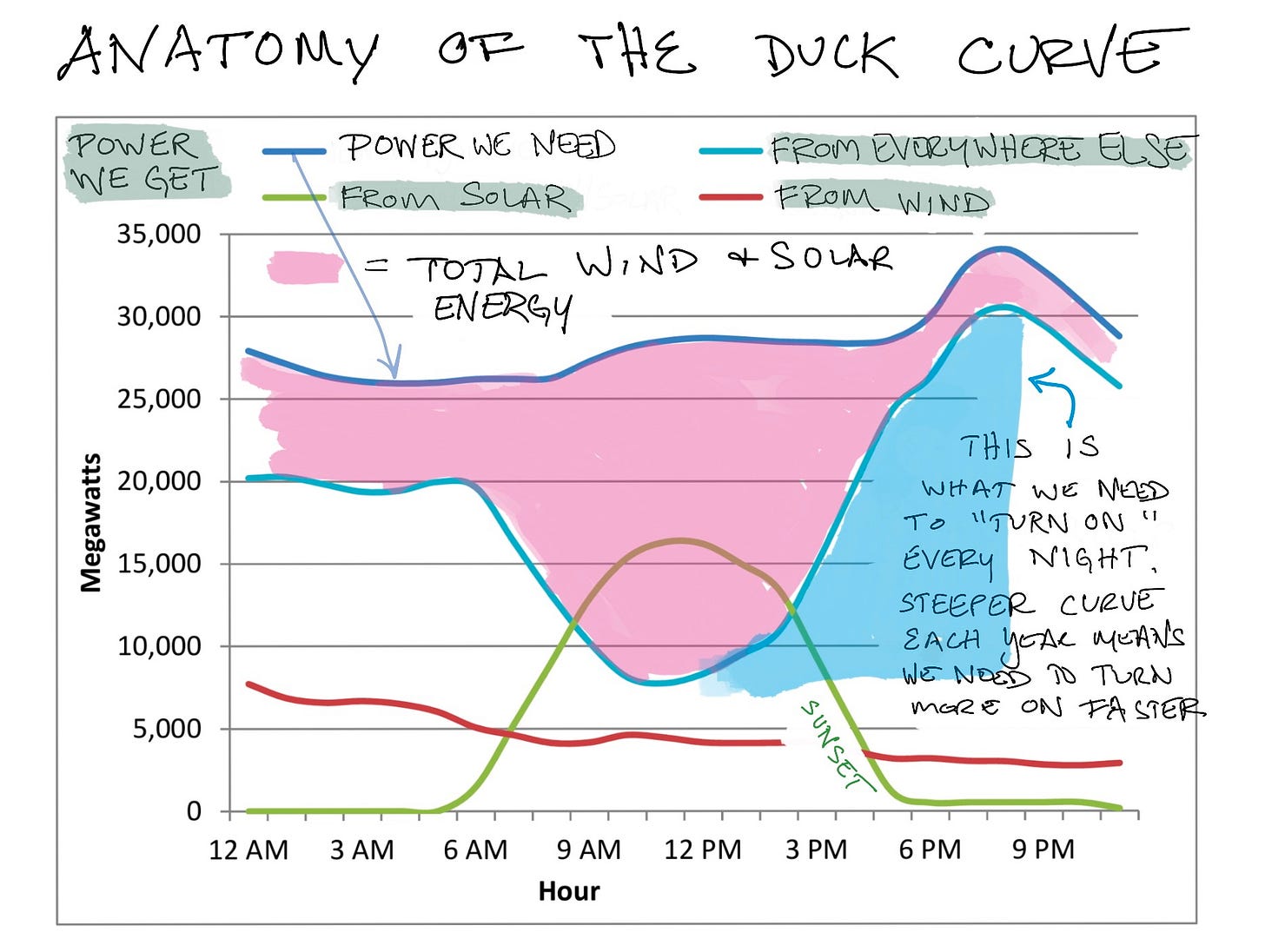

Chart #1: Anatomy of the Duck Curve

There have been lots of duck curve graphs drawn since 2013. I like this one because I can color between the lines.

Let’s walk through this.

Dark blue line = POWER WE NEED over a typical spring day in California. See the bump from 6-9 PM? That’s Netflix streaming, cooking dinner, maybe kicking up the A/C, charging phones and cars.

Red line = POWER we get from WIND. It’s usually stronger in the early hours before dawn and tails off during the day.

Green line = POWER we get from SOLAR. We make the most juice when the sun’s highest. But ramping in and out is something grid operators have to compensate for as the green hill gets taller.

Light blue line = POWER from everything EXCEPT solar or wind (Dark blue line - green line - red line). Bringing this line down is good for the planet, and ever cheaper solar’s a great way to do it, but it creates that steep evening rebound that other sources have to cover.

Pink duck = ENERGY (power over time) from WIND and SOLAR. This is all the fuel we’re getting from renewables. Progress!

Blue triangle = ENERGY TO REPLACE SOLAR in peak hours after sunset. That hypotenuse is getting steeper as we add solar. New challenge!

A professional power plant builder, Freeman understood the blue triangle challenge first hand.

He knew grid operators were about to be asking shouting something like “Hey, we’re going to need a bunch of power over here tomorrow night. Who’s got some I can bring online, and fast?”

He also knew most of the plants on the grid wouldn’t be able to answer that call.

Traditional power plants weren’t built for rapid response

Most power plants are made for turning on and staying on. They can adjust to lots of small requests once they’re running, but they’re slow to wake up, kind of like my kids in the summer. In fact, only about 25% of traditional power plants can get going within an hour. That’s too slow to solve our blue triangle problem.

But batteries are

One thing that IS really good at dumping power when you need it fast is a battery.

Batteries are ready to dump current into your wires whenever you ask because they rely on chemical reactions inside the battery to unlock energy — not thermal then mechanical then electromagnetic reactions like most traditional power plants. (For example, a coal power plant burns coal to heat water to spin a turbine connected to a big spinning magnet that induces electric current inside nearby wires.)

Freeman knew all of this. But he didn’t see the economics of new batteries working yet. Although the price of batteries had dropped almost 97% in the past few decades, new batteries still didn’t quite pencil for grid storage. So he started asking this question:

Could used EV batteries help us solve the duck curve problem?

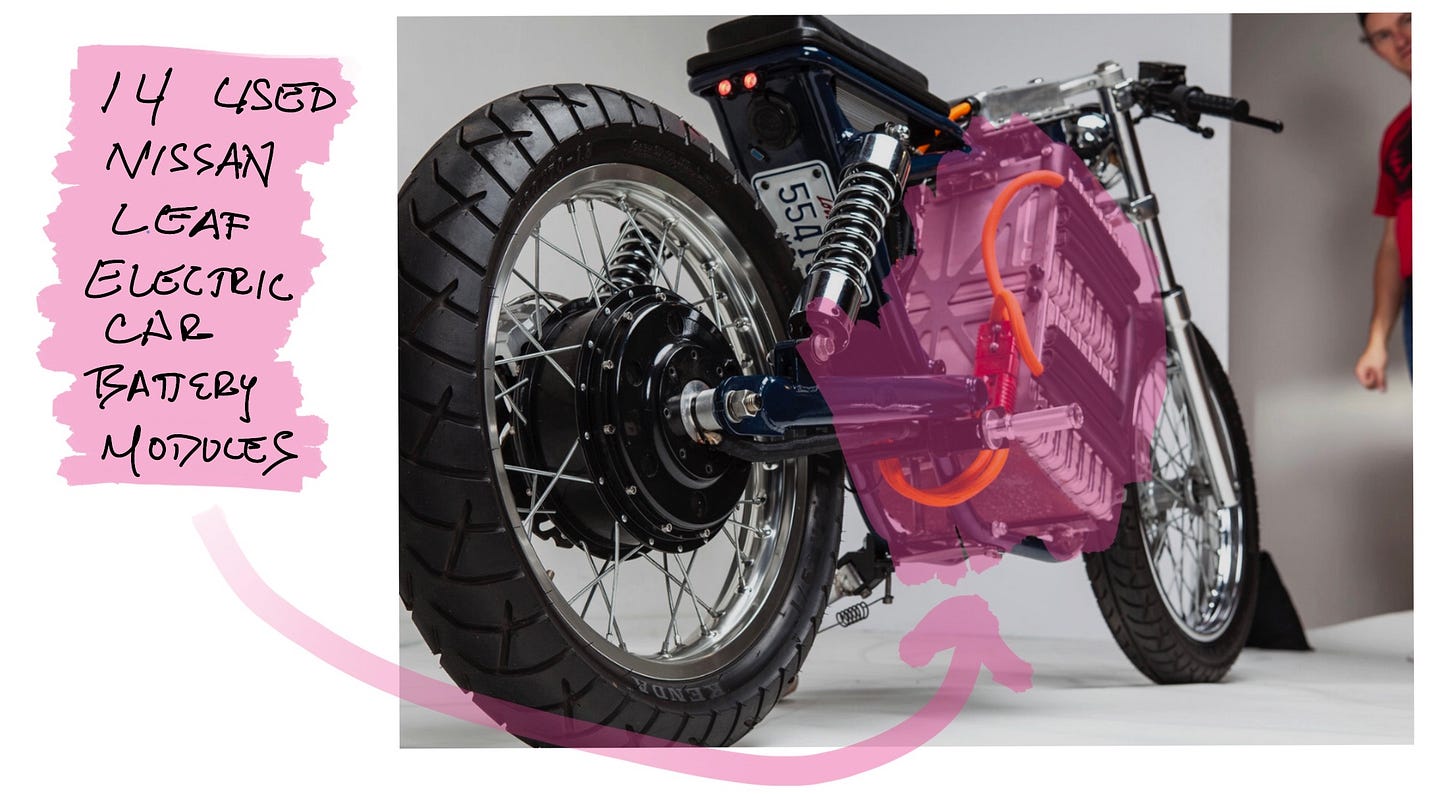

They’d certainly solved my much tinier electric motorcycle conversion problem.

I bought my first used Nissan Leaf modules in 2015, from a guy in Denver who parted-out wrecked Leafs. Here’s a bike with 14 of them where the motor used to be:

I bought my first Tesla module in a Birmingham parking lot soon after that. But since I couldn’t tear it apart, I sold it to a guy in a parking lot outside of Montgomery in 2017.

Used EV batteries completely changed the way I build bikes. They were better engineered, more energy-dense, higher-power, and better for acceleration than most new batteries I tested. By 2019, there were more than enough EV batteries out there to meet the needs of every hobbyist motorcycle converter in the game.

My wave had come in, but Freeman was waiting for a much bigger one.

And it was just over the horizon.

Chart #2: The coming wave of 2nd-life EV batteries

Duck curves weren’t the only kind of charts Freeman was showing me in 2019. He was showing me battery supply charts, too.

McKinsey was predicting we’d see between 112 and 227 Gigawatt hours of 2nd-Life EV batteries coming online globally every year by 2030. If we take the average of these two extremes, we get 170GWh/year.

Let’s connect that supply to the demand for quick power in the blue triangle of our duck curve chart — the energy we have to make up for when the sun sets every day.

If McKinsey’s on target, second-life (used) electric car batteries could help address 4 California’s worth of solar intermittency every a year — with batteries some folks think are worthless.

Converting a few electric motorcycles with used EV batteries a year is…amusing.

Fixing 4 big blue triangles every year with them is…wow.

The largest used EV battery plant in the US

These two charts, the duck curve, and the imminent wave of used EV batteries, helped me understand the need for batteries on the power grid back in 2019. Within a few months, I’d made my first angel investment and gone on the clock to help Freeman reposition his solar development company into a battery development company.

3 years later, B2U’s showing promise. Their first power plant can supply 4 hours of 8 Megawatts (25MWh) every day to the California grid. It’s the biggest of its kind in the US. They’ve started on a second plant. They just finished their first portable Battery Energy Storage System unit; it will let them deliver battery storage far beyond the power plants they run themselves.

Freeman’s team is helping solve a critical-path issue in the clean energy transition. And they’re doing it in a clever way with affordable resources that might otherwise go to waste or get recycled prematurely.

Freeman’s more than a successful CEO, he’s a great teacher. He taught me what’s emerging as the core tenet of My Next Electric’s investment thesis - putting batteries in useful places. The iterations he’s made in three short years, starting with a prototype from with the same battery modules I was jamming into motorcycles, have opened up more opportunity for this exciting not-really-a-startup than either of us I ever imagined.

But that’s the next post. See you there next week.

This post is part of an experiment I’m running this summer with our Investor-In-Residence, Pete Christensen. We’re applying lessons learned in 4 years of angel investing and 2 years of teaching courses on switching to electric cars and appliances to a simple investment thesis. Our working title is Batteries Included.

If you’re interested in investing and/or learning with us, please reach out - mynextelectric.com. Thanks, Matt Candler